Bengaluru

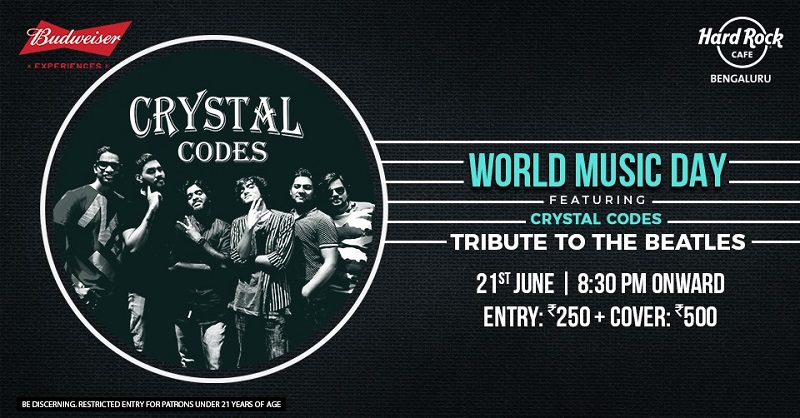

Amp Up Your Evening with ‘Crystal Codes’ Paying Tribute to The Beatles this World Music Day at Hard Rock Cafe

This World Music Day, head to live music destination- Hard Rock Café to be part of a special celebration with a music sensation coming all the way from Dubai!

Bangalore’s most popular progressive rock music band Crystal Codes will be giving a Tribute to The Beatles and some of the greatest classic and progressive rock music of all time at Hard Rock Café Bengaluru this World Music Day.

The Beatles were one of the most successful and critically acclaimed groups in the history of music. They not only influenced the music industry, but they also influenced the social and cultural revolution in the 1960s. Their success made them the influential band they are in the music industry today.

Calling all the Beatles fans in Bengaluru to HRC on June 21st to witness Crystal Codes paying tribute to this legendary band and also witness some of the greatest classic and progressive rock music of all time.

So, let your souls ignite this World Music Day with the band that promises to up-lift your evening!

When: June 21, 2019 | 8:30 PM

Where: Hard Rock Cafe, Bangalore

Price: 250 Entry + 500 Cover Book Now